Few investors are happy with their returns. Here’s how to take a more positive outlook

You may already know that investing is a long-term journey that requires patience and discipline – but that doesn’t mean your emotions might not get in the way.

In a recent study of nearly 800 individuals with more than £25,000 invested in the stock market, only 47% of respondents said they were “happy” with the performance of their portfolio in the last 12 months. The remaining 53% were dissatisfied with their returns.

Breaking down the responses, which were published by MoneyAge in July 2024:

- 45% said high inflation has made it difficult to manage their investments.

- 32% revealed that rising interest rates have negatively affected the performance of their portfolio in the last two years.

- 38% said geopolitical conflicts and instability have affected their strategies over the last 12 months.

- Only 40% said they were confident that their investments would perform well in the next year.

These sentiments are understandable. In the last five years, political upheaval and the Covid-19 pandemic have made economic conditions difficult for savers and investors who are trying to plan for the future.

Against the backdrop of these events, it could be easy to adopt a pessimistic investment mindset. However, there is plenty to be hopeful about for all investors – if you know how to adopt a positive, long-term investment philosophy that shuts out media noise and focuses on your goals.

Keep reading to discover how to revitalise your optimism when it comes to investing by taking a long-term view.

It can be unhelpful to review your investment portfolio’s performance more than once a year

While it can be fun to check in on how your investments are performing, in general, daily or even monthly reviews of your portfolio could prove more stressful than helpful.

If you notice that some of your holdings have dipped in value, this might prompt you to panic and act unnecessarily, perhaps even selling off investments that aren’t doing well.

There is a very recent example of how panic-selling could hurt your portfolio’s performance over the long term.

On Monday 5 August 2024, according to the Guardian, Japan’s Nikkei 25 index saw its biggest selloff in 37 years, affecting global markets and spooking investors. Yet the very next day, the same index jumped by 10%, regaining most of the capital investors had lost.

If you had checked the value of your portfolio on 5 August and sold off any shares held in the Nikkei 25, you would have crystallised those losses. Whereas, remaining invested despite the turbulence would have allowed your shares to regain much of their value in the space of just one day.

This is why it may be helpful to seek the advice of a professional. Once a year, your financial adviser will review your portfolio’s performance with you and explain the progress made, giving you insights into how this fits into your long-term plans.

Taking a more passive approach to your portfolio with the help of your adviser might prevent you from acting rashly on a day-to-day basis.

Looking at historic market data may make you more optimistic about the future

While past performance is not a reliable indicator of future performance, looking at how markets have responded to global events in previous years might help you reframe the narrative around investing.

Indeed, it’s hard to ignore the events that have affected stock market performance in recent years – namely, Covid-19, and the high inflation and rising interest rates that followed, along with several important geopolitical events.

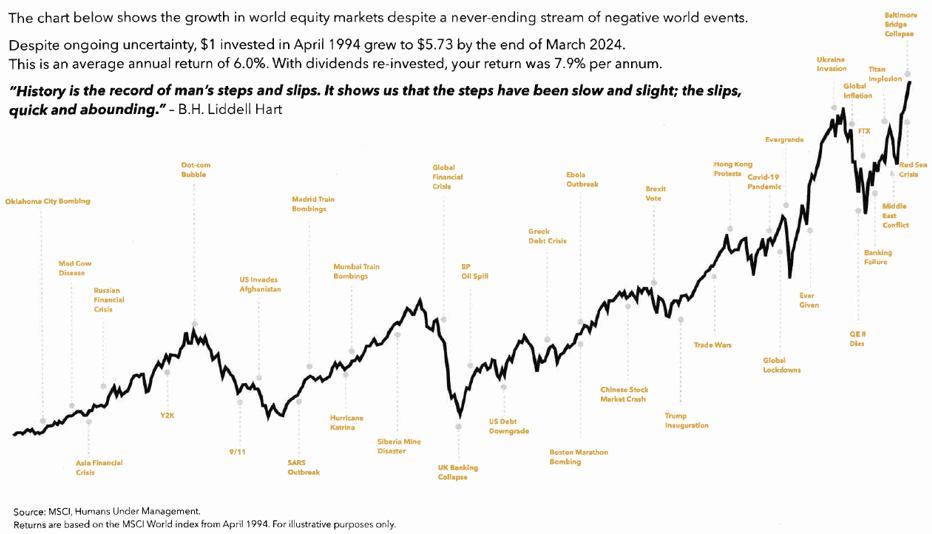

Yet history shows us that markets are good at “climbing the wall of worry”, that is, overcoming these short-term hits to asset values and rising above them in the following years.

Source: Humans Under Management Past performance is not a reliable indicator of future performance.

As you can deduce from the above graph, despite the near constant occurrence of market-affecting global events, the MSCI World Index returned 6% a year on average between April 1999 and March 2024.

So, if you are someone who has been disappointed by your investment returns since 2019, you aren’t alone. But falling into a pessimistic mindset about investing, and being tempted to chop and change your strategy as a result (or withdraw entirely) is unwise.

A long-term view can help to boost your enthusiasm for investing

You might be wondering: “I understand that markets normally recover, but I’d rather not take the risk. Can’t I just keep my money in an interest-paying cash account?”

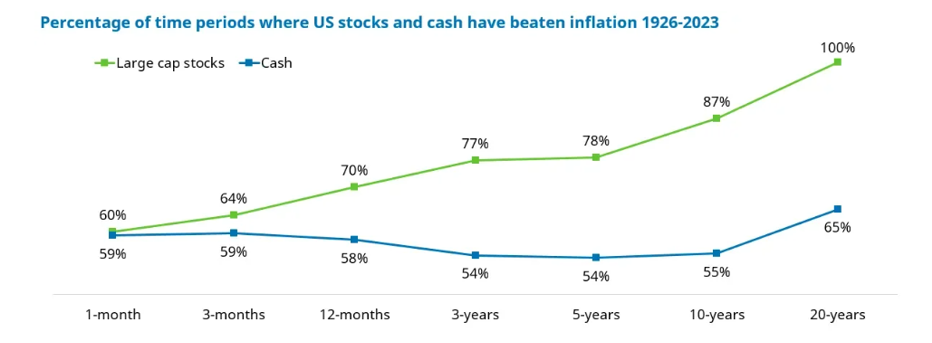

While there is nothing to stop you from doing so, it is crucial to remember that over the short term, while cash is a safe bet, long-term data shows that stocks are more reliable when measured against inflation.

Indeed, data produced by Schroders shows that over a period of 20 years or more, large-cap stocks rise faster than inflation 100% of the time. On the other hand, cash only outpaces inflation 65% of the time.

Source: Schroders Past performance is not a reliable indicator of future performance.

So, while 38% of the initial survey’s respondents said that geopolitical events had “affected their strategies” over the last 12 months, remember that sometimes the best action is to do nothing at all. Remaining invested according to your long-term plan is likely to produce more reliable returns than cashing in the moment something goes “wrong” with your portfolio.

Looking at this long-term market data could help you reframe your negative investment narrative, encouraging you to remain positive as you work towards your future goals.

Get in touch

Here at Chancellor, we specialise in helping our clients meet treasured life goals. Whether you’re a seasoned investor or are entirely new to it, we’re here to guide you through your journey with a positive, professional outlook.

Email info@chancellorfinancial.co.uk, or call 01204 526 846 to speak to an adviser.

If you’re already a client here at Chancellor, contact your personal financial adviser to discuss any of the content you’ve read in this article.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.